Planning Education Expenses for Sustainable Long-Term Outcomes

Managing education costs requires forward-looking choices and flexible planning to avoid surprises. Effective preparation balances realistic projections with adaptable savings and spending strategies. Families and institutions benefit from breaking large goals into manageable steps and reviewing plans regularly. This article

How to Balance Education Costs with Family Goals

Planning for education expenses is an ongoing process that requires both short-term decisions and long-term vision. Families often juggle tuition, supplies, extracurricular activities, and unexpected costs while trying to align spending with broader goals. A practical approach combines honest financial

Managing Education Expenses with Practical, Flexible Strategies

Education expenses are an evolving challenge for many families and individuals planning for long-term learning goals. Rising tuition, ancillary fees, and living costs can make planning feel overwhelming without a clear approach. This article outlines practical, flexible strategies to assess

Building a Flexible Plan for Education Expense Management

Paying for education requires a flexible plan that adapts to changing needs and timelines. Families and individuals face tuition, materials, and opportunity costs that evolve over years. A clear framework helps set priorities without sacrificing financial resilience or long-term goals.

Planning Education Costs Across Every Stage of Learning

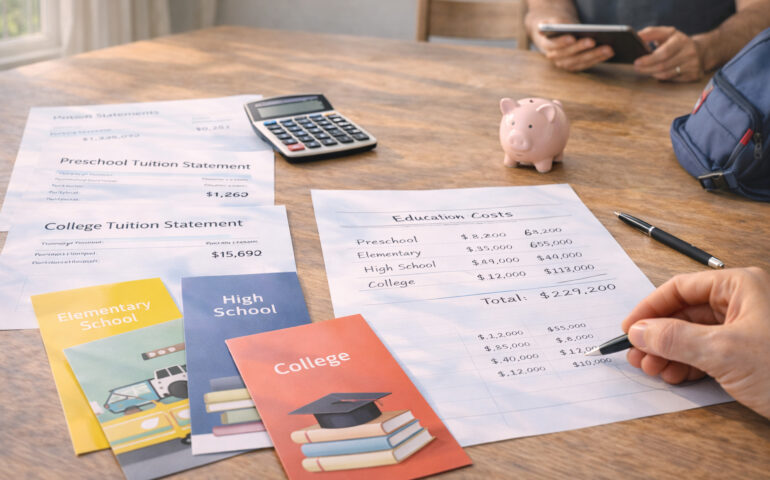

Estimating education expenses requires a mix of realistic forecasting and flexible planning. Start by listing tuition, fees, housing, materials, and incidental costs to form a base figure. Factor in inflation and potential changes in program length to avoid surprises later.

Practical Approaches to Managing Education Expenses Effectively

Education costs continue to shape family budgets and institutional planning, so a clear approach matters. Identifying fixed and variable expenses helps prioritize spending and find savings. Small changes in study materials, schedules, or vendor choices can add up to meaningful

Smart Budgeting for Long-Term Education Expenses

Planning for education costs requires discipline, clarity, and realistic assumptions. Establishing priorities early helps families and students align savings with goals. Unexpected expenses can erode plans, so building flexibility into a budget is important. This introduction outlines practical steps to

The Role of Financial Advisors in Education Planning

Education planning has become more complex as tuition costs rise, funding options expand, and economic conditions remain uncertain. Families and students must balance short-term affordability with long-term financial health. Financial advisors play an important role in this process by helping

How to Reduce Education Costs Through Community Colleges

Rising tuition costs make higher education feel out of reach for many students and families. Community colleges offer a practical, cost-effective alternative that can significantly reduce education expenses without sacrificing quality. By understanding how community colleges fit into broader education

How to Plan for Education Costs During Economic Uncertainty

Rising education expenses combined with economic uncertainty can make planning for the future feel overwhelming. Tuition, housing, books, and related costs often increase even when household income feels less predictable. The key to managing education costs during uncertain times is