Rising education expenses create uncertainty for students and families alike.

Understanding the components of these costs makes planning easier and more effective.

This article outlines practical steps to assess, prioritize, and manage education spending.

Implementing a structured approach helps keep goals realistic and budgets balanced.

Tracking expenses month to month improves accuracy and informs future adjustments.

Assessing Total Education Costs

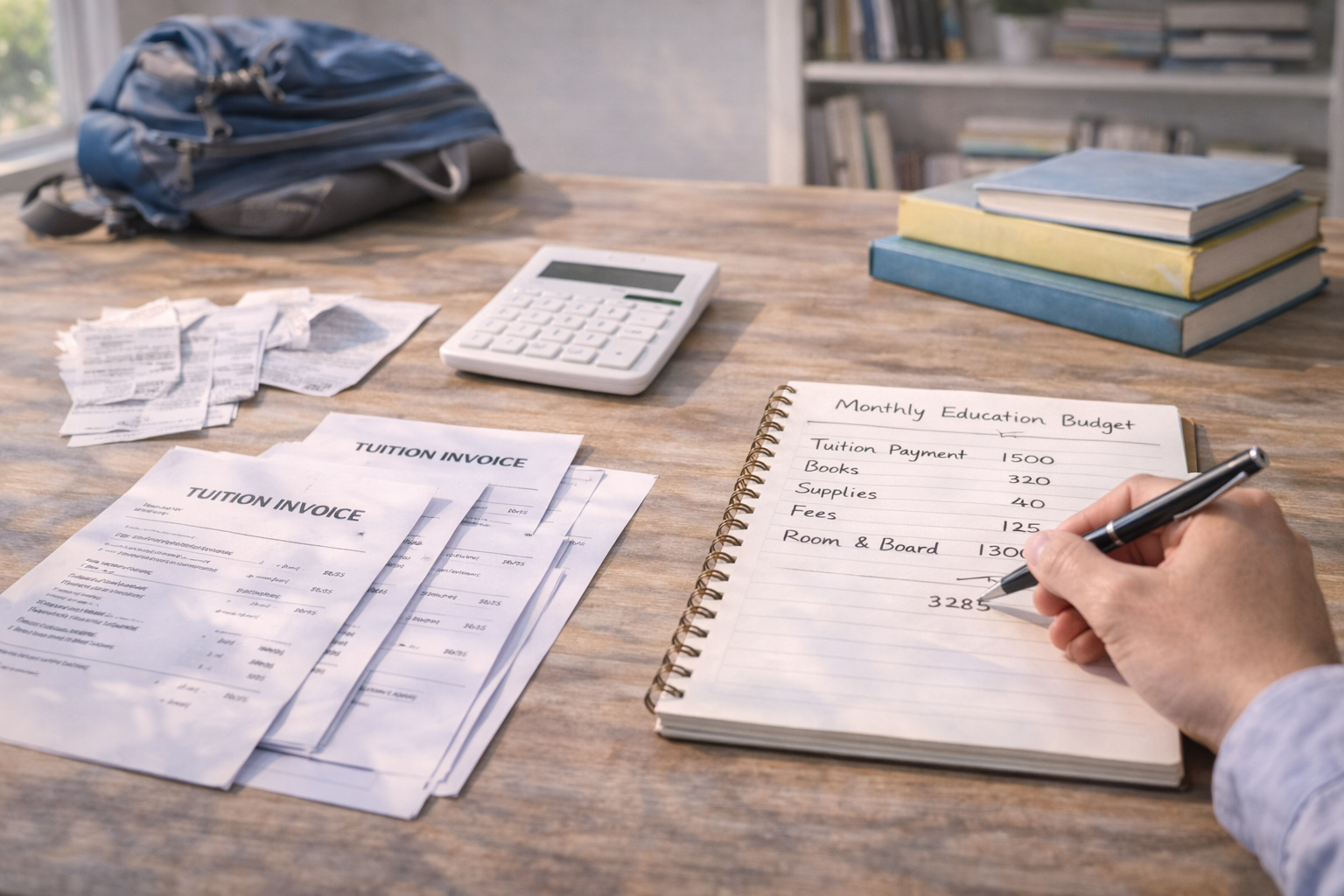

Start by identifying all direct and indirect costs associated with education, including tuition, fees, materials, and living expenses to form a complete picture. Factor in irregular costs such as exam fees, travel, technology upgrades, and unexpected supplies to avoid budget shortfalls. Consider opportunity costs like reduced work hours or additional commuting time when estimating the full financial impact. Use billing statements, course syllabi, and institutional resources to build a comprehensive estimate that reflects likely variations. Regularly update this assessment as program requirements, schedules, and personal circumstances change to maintain accuracy.

Clear visibility into total costs is the foundation of any effective plan and supports informed decision-making. Writing down figures increases accountability and makes it easier to compare funding options. With a reliable assessment, families and students can proceed with confidence.

Prioritizing and Reducing Expenses

Once you have a complete cost picture, rank expenses by necessity and impact on academic success so that essential items receive first attention. Look for areas where costs can be trimmed without compromising outcomes, such as choosing used textbooks, sharing resources, or adjusting housing choices. Explore campus resources, peer networks, and community programs that can provide low-cost alternatives or one-time support. Evaluate trade-offs between convenience and cost and build a short list of nonessential expenses that can be reduced when budgets tighten. Engaging students in these conversations fosters financial responsibility and smarter spending decisions.

- Search early for scholarships, grants, and institutional aid to reduce reliance on loans.

- Rent or buy used materials, use digital or library resources, and join study groups to share costs.

- Compare housing, meal plans, and transport options for the best balance of cost and quality.

Small changes in consumption and purchasing habits can lead to significant savings over time and create room for important investments. Prioritizing essential expenses preserves resources for core educational needs. Regular reassessment ensures priorities stay aligned with goals.

Building a Flexible Savings and Funding Strategy

Create a funding mix that may include personal savings, part-time work, family contributions, and responsible borrowing to spread risk and maintain flexibility. Establish an emergency buffer for unexpected charges to avoid costly short-term solutions and to protect academic progress. When available, use savings vehicles or institutional payment plans that reward consistent contributions and offer predictable terms. Plan for both short-term liquidity needs and longer-term education goals to avoid overshooting budgets. Revisit your strategy periodically as income, aid eligibility, and academic plans evolve.

Flexibility reduces the risk of disruption and helps students remain focused on learning and outcomes. Conservatism with borrowing and a commitment to incremental savings strengthen long-term financial health. Combining multiple funding sources increases resilience against unforeseen changes.

Conclusion

Managing education expenses requires a clear inventory of costs, thoughtful prioritization, and a flexible funding plan.

Implementing consistent actions—like seeking aid, trimming nonessential spending, and maintaining an emergency buffer—builds financial resilience.

With disciplined planning and regular review, students and families can make education more affordable without sacrificing quality.