The Role of Government Aid in Supporting Education

Government aid programs significantly reduce educational expenses for eligible students. Grants, subsidies, and low-interest student loans are designed to ensure that financial challenges don’t block access to education. These programs vary widely depending on the country and the student’s background.

How Inflation Affects Educational Expenses

Rising inflation directly impacts the affordability of education worldwide. Inflation increases tuition fees, accommodation costs, and the price of daily necessities. Even small annual increases accumulate into significant financial burdens over the course of a degree. Families saving for education

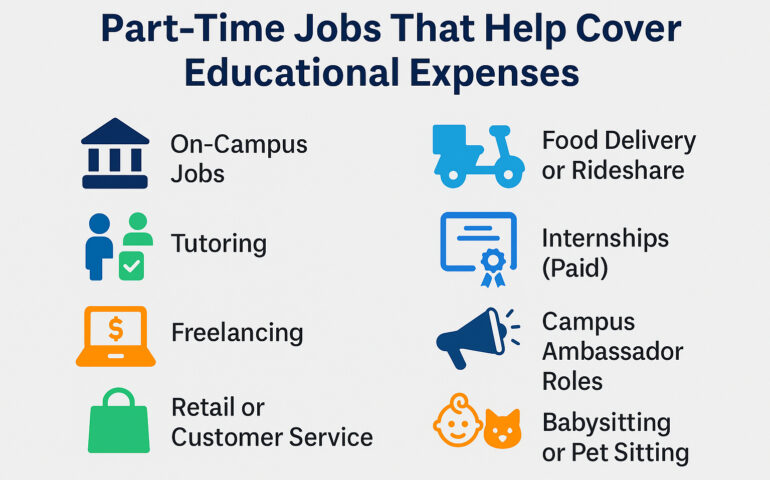

Part-Time Jobs That Help Cover Educational Expenses

Education is an investment, but it often comes with hefty costs—tuition, books, housing, and daily expenses. For many students, part-time jobs are a practical way to earn extra income while gaining valuable skills. The key is choosing jobs that provide

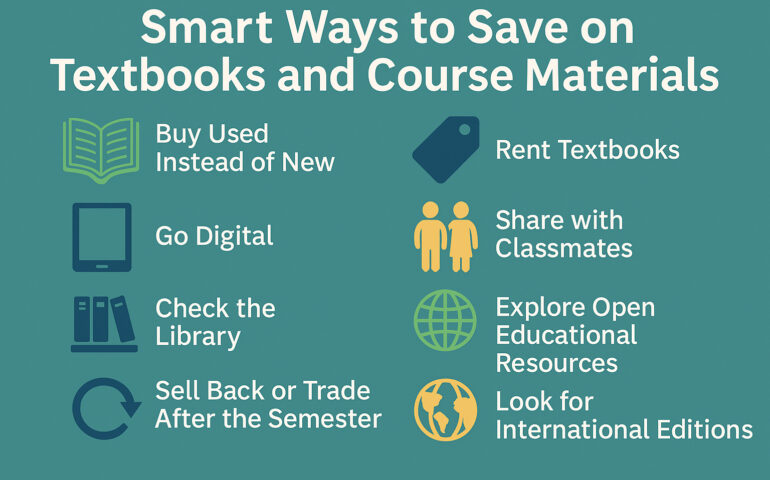

Smart Ways to Save on Textbooks and Course Materials

For students, textbooks and course materials are often one of the biggest hidden costs of education. A single semester can run into hundreds of dollars—or more—just for books and resources. The good news? With a little creativity and planning, you

How to Track and Reduce Monthly School Spending

For many families, school expenses make up a significant part of the monthly budget. From tuition and books to uniforms, transport, and extracurricular activities, costs can add up quickly. The key to managing these expenses is not just cutting costs

Understanding Education Expenses: Planning for the Future

Education expenses cover a wide range of costs including tuition fees, books and study materials, technology requirements, living expenses, and additional charges such as examinations or extracurricular activities. With the rising demand for higher education, inflation, and the growing need

Educational Loans: What Every Student Should Know

Introduction When savings and scholarships aren’t enough, many students turn to educational loans. While loans can open doors to opportunities, they also come with long-term responsibilities. Things to Consider Before Taking a Loan Interest Rates: Compare lenders carefully. Repayment Terms:

How Students Can Manage Daily Educational Expenses

Introduction Managing money during school or college can be tough, especially with rising costs. Students often juggle tuition, books, and living expenses while trying to stay focused on their studies. With smart habits, students can stretch their budgets further. Practical

How to Cut Down Education Costs Without Compromising Quality

Quality education doesn’t always mean excessive spending. With the right approach, students and families can minimize costs while still getting the best learning experience. 1. Choose the Right Institution Sometimes local or state colleges offer excellent programs at lower costs

Managing Education Expenses: Smart Financial Planning for Students and Parents

Education is one of the most valuable investments, but rising costs can put pressure on families. With careful planning, managing education expenses doesn’t have to be overwhelming. 1. Understand the Costs Tuition fees are just the beginning. Add expenses for