Financial Aid Deadlines: How Missing Deadlines Can Increase the Cost of Your Education by Thousands

Navigating the complexities of financial aid for college can be daunting, especially when every decision feels critical. A common but overlooked trap is missing financial aid deadlines, which can have far-reaching consequences for the overall cost of your education. Here’s

Summer Break Financial Pressure: How the Gap Between School Terms Can Cause Students to Fall Behind Financially

As summer break approaches, students may find themselves facing a dilemma that’s often overlooked: the financial gap between school terms. While summer offers a chance for rest, relaxation, and internships, it also brings financial challenges. Without the structure of school

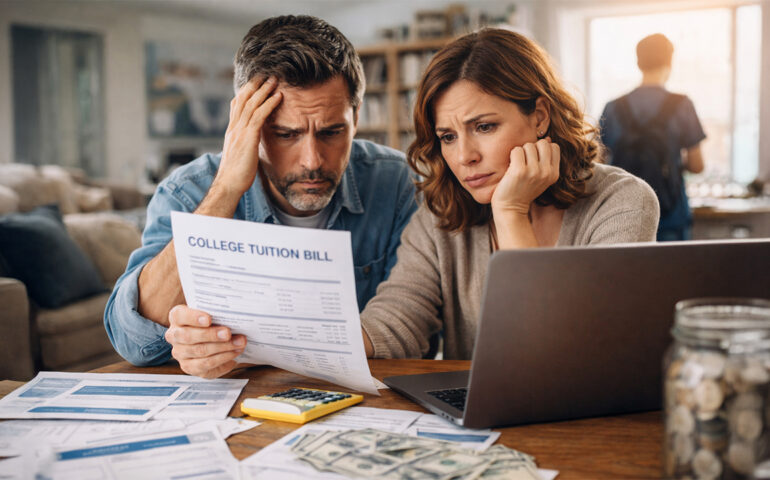

The Parent Contribution Factor: Why Some Families End Up Paying More Than They Expected for College

When it comes to paying for college, many families are caught off guard by the Parent Contribution Factor (PCF), a key element in determining how much parents are expected to contribute to their child’s education. The PCF, part of the

The Social Academic Cost: Expenses Linked to Networking, Clubs, and Leadership Roles

Academic success isn’t shaped by coursework alone. Networking events, student clubs, leadership programs, and extracurricular roles play a growing role in career outcomes—but they also introduce a less visible financial layer. This layer, often overlooked in tuition planning, forms what

The Parent-PLUS Planning Gap: How Late Borrowing Increases Total Repayment Costs

Many families treat Parent-PLUS loans as a last-resort option, something to use only if scholarships, grants, and student loans fall short. However, this late-stage reliance often creates a hidden planning gap that quietly raises the total cost of education. When

The Academic Calendar Cost Trap: How School Schedules Create Unplanned Spending

Academic calendars are designed for instruction, not affordability. Yet the structure of semesters, breaks, and deadlines quietly drives a pattern of unplanned spending that many students and families don’t anticipate. This dynamic—known as the Academic Calendar Cost Trap—turns time-based decisions

The “Too Much Support” Effect: When Financial Help Increases Spending

Financial support is designed to relieve pressure—but in some cases, it does the opposite. The “Too Much Support” effect explains why additional financial help can unintentionally lead to higher spending, weaker self-control, and reduced long-term stability. Instead of creating security,

The Furniture Cycle: Rebuying What You Already Owned Every Academic Year

Each academic year, millions of students repeat the same expensive habit—rebuying furniture they already owned just months earlier. This pattern, known as the Furniture Cycle, quietly drains student budgets and inflates education-related living costs far beyond tuition and books. What

Internship Economics: How Early Work Experience Reduces Total Education Costs

Internships are often framed as career accelerators—but their financial impact is just as powerful. Internship Economics explains how early, practical work experience can significantly reduce the total cost of education, even when internships are unpaid or modestly compensated. The savings

The FAFSA Timing Advantage: Why Filing Early Can Mean More Aid

Every year, millions of students complete the FAFSA to access federal, state, and school-based financial aid. But what many don’t realize is that timing plays a major role in how much aid they receive. Filing early — ideally as soon